Reversing from the positive sentiment of the previous day, the Colombo Bourse faced selling pressure as investors opted to book profits during the trading session.

In the early hours of trading investors booked profits with the index experiencing a sharp decline, but the index gradually recovered, experiencing sideways movements.

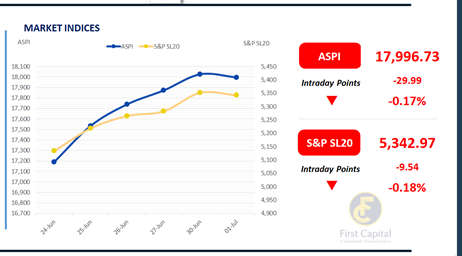

However, the ASPI ultimately failed to close in the green, halting at 17,997, down by 30 points. The Banking sector, including counters like HNB and NDB, exerted negative pressure on the index, along with CDB, CTHR and CARS.

Retail and high-net-worth investor participation remained strong, with turnover reaching LKR 7.6Bn, reflecting a 55% increase from the monthly average of LKR 4.9Bn.

Notably, 1.7% of LOFC’s stake was traded through an off-board transaction at LKR 6.0 per share, generating a turnover of LKR 3.3Bn. The Diversified Financials sector was the top contributor to today’s turnover, accounting for a share of 55%.

This was followed by the Capital Goods and the Banking sectors, which produced a joint contribution of about 20%. Foreign investors remained net sellers, with a net outflow of LKR 3.4Bn.

BOND MARKET

A day of lackluster activity and cautious interest

The secondary market extended yesterday’s tone into today’s session, with modest buying interest continuing to concentrate in the 2028 and 2029 maturities.

However, despite this focused demand, broader market sentiment remained subdued, with overall activity and traded volumes reflecting a largely dormant environment.

Amidst the 2028 maturities that were traded 15.02.2028, 15.03.2028, 01.05.2028, 01.07.2028 and 15.10.2028 were seen changing hands between 8.71% to 8.83%.

Moving ahead on the yield curve, the 15.12.2029 maturity traded at a rate of 9.40%. In light of today’s subdued market tone, notable trading activity was largely confined to these segments.

In the forex market, the LKR appreciated marginally against the greenback, closing at LKR 299.95/USD, compared to the previously seen rate of 299.97/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 110.8Bn from the previously seen level of LKR 138.1Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..