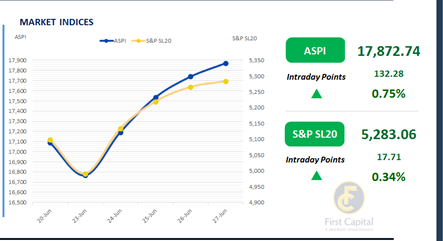

Continuing the positive momentum from the previous day, the Colombo Stock Market reached a new all-time high, surpassing yesterday’s record amid easing risk premia attached to global tensions.

The market opened on a bullish note, with some profit-taking observed during the early hours of trading. However, the index gradually recovered and closed at 17,873, marking a gain of 132 points.

CTHR, JKH, SAMP, HNB, and CDB were among the top positive contributors to the index. Retail and high-net-worth investor participation remained strong throughout the session. Turnover for the day stood at LKR 5.1Bn elevated, yet nearly 6.0% lower than the monthly average of LKR 5.4Bn.

The Capital Goods sector was the top contributor to today’s turnover, accounting for a share of 24%. This was followed by the Diversified Financials and Materials sectors, which produced a joint contribution of about 29%. Foreign investors remained net sellers, with a net outflow of LKR 441.5Mn.

BOND MARKET

CBSL's largest YTD T-Bond auction falls short of full acceptance

CBSL conducted its year-to-date largest T-Bond auction, raising LKR 240.7Bn, 18.5% below the initially offered amount of LKR 295.0Bn. This amount was raised through the issuance of 2029, 2031, 2033 and 2037 maturities which registered weighted average yields of 9.41%, 10.00%, 10.68% and 10.83% respectively.

Following the T-Bond auction amongst the traded maturities, 15.06.2029, 15.09.2029, 15.10.2029 and 15.12.2029 maturities were traded at the range of 9.35% to 9.50%. Meanwhile, 15.12.2032 maturity was changed the hands at the rates between 10.35% to 10.40%.

In the forex market, the LKR appreciated against the greenback, closing at LKR 299.97/USD, compared to the previously seen rate of 300.22/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 128.8Bn from the previously seen level of LKR 123.5Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..