The Bourse reopened after the long holiday weekend, kicking the week off on a strong note with robust investor participation driving early momentum.

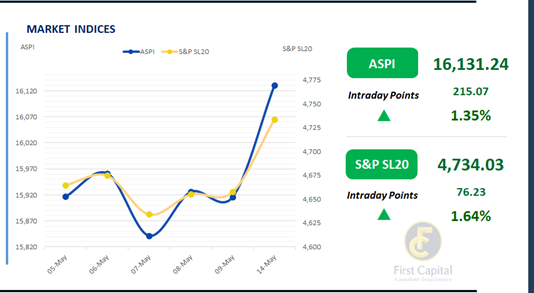

The ASPI showed steady growth throughout the session, gaining 215 points to close at 16,131, marking its first time above the 16,000 mark since the 2nd of April 2025.

HNB, CFIN, COMB, SAMP and SPEN were the key positive drivers of the index. The easing of China-U.S. tariffs and an immediate India-Pakistan ceasefire boosted global sentiment, sparking a strong market rebound as both HNW and retail investors returned from the holidays with renewed optimism and active participation.

Investor sentiment was elevated towards certain Hotel sector and blue-chip counters whilst the Diversified Financials sector registered the highest in terms of sector-wise returns.

The turnover surged to LKR 3.4Bn, reflecting a 46.9% increase from the monthly average of LKR 2.3Bn. The Capital Goods sector led today’s turnover with a 30% share, followed by the Diversified Financials, and Food, Beverage & Tobacco sectors jointly accounting for 31%. Foreign investors remained net buyers, with a net inflow of LKR 25.5Mn.

Auction yields hold ground; market kicks off with fresh buying

CBSL conducted its weekly T-Bill auction today, raising LKR 173.0Bn, in line with the initial offering whilst of this, LKR 111.1Bn was raised via 12M T-Bill.

The weighted average yields for all three maturities remained unchanged at 7.65% (3M), 7.98% (6M) and 8.30% (12M), respectively compared to the previous auction. Following the long holiday, the secondary market opened the week with renewed buying interest, marking a shift from the subdued sentiment of the previous week.

Despite this pickup in activity, the yield curve remained unchanged, with trading volumes staying at moderate levels. Amongst the traded maturities, 15.03.2028 and 01.05.2028 maturities traded between the rates of 9.80% to 9.70% whilst both 15.10.2028 and 15.12.2028 traded at the rates of 9.85% to 9.87%.

Meanwhile 15.06.2029, 15.09.2029 and 15.12.2029 bond maturities traded between the rates of 10.25% to 10.15%. Additionally, 15.03.2031 maturity changed hands at the rates of 10.68% to 10.65%.

In the forex market, the LKR continued to appreciate against the greenback, closing at LKR 298.9/USD, compared to the previous day’s rate of 299.3/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 183.1Bn from LKR 194.5Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..