The Colombo bourse witnessed a volatile trading session with the ASPI sharply declining in the early hours followed by gradual recovery.

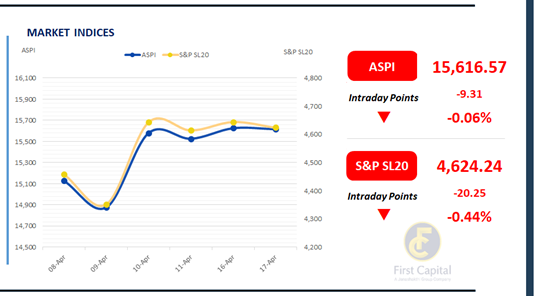

The ASPI remained broadly flat, reporting a 9-point drop, closing at 15,617. Investor participation remained subdued, mirroring the previous session, amid seasonal activity, with both retail and HNW segments showing limited engagement.

SAMP, HNB, DFCC, MELS and LOLC emerged as the top negative contributors to the index. Specific counters within the Diversified Financials sector, including COCR and CFIN, attracted notable positive sentiment.

Following the announcement of VAT exemptions on dairy products, investor focus pivoted to LMF and CCS, driving renewed momentum in both counters.

The turnover stood at LKR 841.2Mn, marking a 68.2% decrease from the monthly average of LKR 2.6Bn. The Food, Beverage & Tobacco sector was the most significant contributor to the turnover with a 22% share, followed by the Banking, and the Diversified Financials sectors jointly contributing 35%. Foreign investors remained net sellers, with a net outflow of LKR 2.1Mn.

Market slumbers through the holiday drag

Much like the day before, the secondary bond market remained subdued as the holiday season continued to cast a quiet spell over trading activity.

In the midst of this lingering lull, market volumes remained thin, with only a sparse number of transactions recorded.

Consequently, the 15.03.2028 maturity traded at 10.04%, while the 01.05.2028 maturity followed closely, trading at 10.11%. This was trailed by the 15.10.2028 and the 15.12.2029 maturities, which traded at 10.25% and 10.56% respectively.

In the forex market, the LKR appears to have weakened against the greenback, closing at LKR 298.6/USD, compared to the previous day’s rate of 298.1/USD.

Meanwhile, overnight liquidity in the banking system registered a feeble uptick, standing at LKR 57.3Bn, from LKR 56.9Bn in the prior session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..