The bourse bounced back from yesterday’s dip with a sharp surge during the first 10 minutes of trading, followed by slight volatility during the rest of the day.

The announcement regarding a 90 day pause on the US tariffs resulted in global markets gaining positive traction, followed by the CSE.

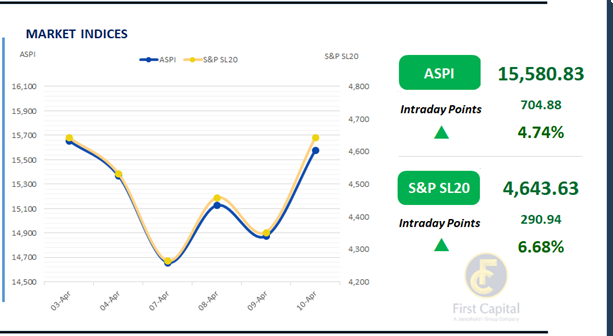

The ASPI closed in the green gaining 705 points, reflecting a 4.74% gain to close at 15,581. Positive contributors to the index far outweighed negative ones, with COMB, HNB, SAMP, JKH and LOLC leading the gains.

Both HNW and retail investors remained active in today’s trading session contributing to increased levels of turnover.

Strong buying interest was noted among Banking sector and blue-chip counters amidst active participation.

The turnover stood at LKR 7.0Bn, marking a significant 190.9% increase from the monthly average of LKR 2.4Bn, mainly due to HNW participation.

The Banking sector was the most significant contributor to the overall turnover with a 43% share, followed by the Capital Goods sector at 22% and the Consumer Durables sector at 6%.

Foreign investors remained net buyers, with a net inflow of LKR 122.3Mn.

US tariff pause shifts market mood, yields retreat across the board

Today marked a decisive shift from the sustained selling sentiment that had weighed on the secondary bond market, a trend largely precipitated by the tariff measures recently unveiled by the United States.

The market’s mood turned on the back of the US’s announcement of a 90-day suspension of reciprocal tariffs for most countries, including Sri Lanka.

Investors, buoyed by this favorable turn of events, pivoted to a buying sentiment. This wave of optimism pushed the yield curve lower across the board, with yields dropping by approximately 30bps. Consequently, the 15.02.2028 and 15.03.2028 maturities traded at 10.00% while the 01.05.2028 maturity traded at 10.10%.

Moreover, the 01.07.2028 maturity transacted at 10.15% and the 15.10.2028 maturity traded at 10.20%. Finally, the 15.09.2029 maturity and the 15.12.2029 maturity traded at a rate of 10.60%.

The upbeat sentiment in the secondary market was mirrored in the T-Bond auction held today. A total of LKR 75.0Bn was raised through the 15.12.2029 maturity, with the weighted average yield coming in at 10.64%.

Additionally, LKR 25.0Bn was secured through the 15.09.2034 maturity, which saw a weighted average yield of 11.21%. Notably, the auction was fully subscribed, reflecting improved investor confidence.

In the forex market, the LKR weakened against the greenback, closing at LKR 301.20/USD, compared to the previous day’s rate of 298.61/USD. Meanwhile, overnight liquidity in the banking system decreased to LKR 135.3Bn, down from LKR 177.7Bn in the prior session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..