The Colombo Bourse saw a further continuation of the selling and profit-taking sentiment that prevailed over the last couple of days.

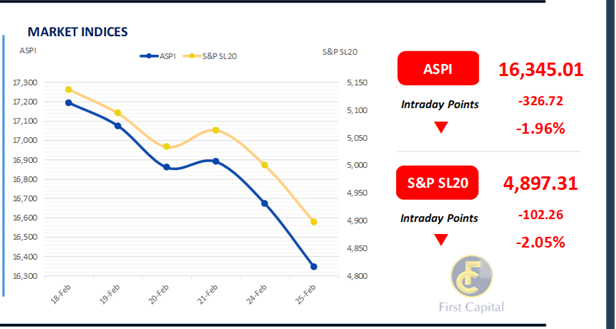

The ASPI dwindled by 327 points and concluded the day in the red at 16,345. The index spiraled down from the early hours of today’s session.

While there were signs of a meagre recovery around midday, the downward trend continued to assert dominance as the day progressed.

Similar to yesterday, Banking sector counters continued to exert adverse pressure on the ASPI with COMB and HNB standing among the top negative contributors.

CINS emerged as the top negative contributor to the index with MELS and LOLC also diffusing noteworthy adverse pressure. Positive contributors remained weak in both number and intensity with GUAR and RIL being the only significant ones.

Turnover also remained dormant but registered a small recovery compared to yesterday as it concluded the day at LKR 2.3Bn.

However, this was still lower than the monthly average of LKR 5.2Bn. In terms of contributions to turnover, the Banking sector took the lead with a contribution of nearly 30%. This was followed by Capital Goods, and the Food, Beverage and Tobacco sectors, which produced a joint contribution of 35%. Finally, foreign investors were net sellers, and the market registered a total outflow of LKR 64.4Mn.

A cautious approach emerges ahead of the bond auction

In today’s weekly T-Bill auction, the weighted average yield rates experienced a further decline. The weighted average yield rates for the 3M, 6M, and 12M T-Bills stood at 7.57%, 7.87%, and 8.35%, respectively, reflecting auction yield drops of 4bps, 3bps, and 1bps.

Furthermore, CBSL offered a total of LKR 140.0Bn worth of T-Bills collectively, and this amount was fully subscribed. In the secondary market, market participants adopted a cautious approach ahead of the T-Bond auction, resulting in moderate trading volumes.

Amongst the traded maturities notable trades were recorded in 2027, 2028, 2029 and 2030 bond maturities. Accordingly, at the short end, 15.09.2027 maturity traded at the rate of 9.40%. Whilst towards the belly end 15.03.2028, 01.07.2028 and 01.09.2028 maturities traded at the rates of 10.05%, 10.27% and 10.30%, respectively.

Furthermore, 15.07.2029, 15.09.2029 and 15.12.2029 traded at the rates of 10.76%, 10.77% and 10.80% respectively. Additionally, 15.05.2030 and 15.10.2030 bond maturities traded at the rates of 11.00% and 11.12% respectively.

The CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system contracted to LKR 151.1Bn from LKR 159.7Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..