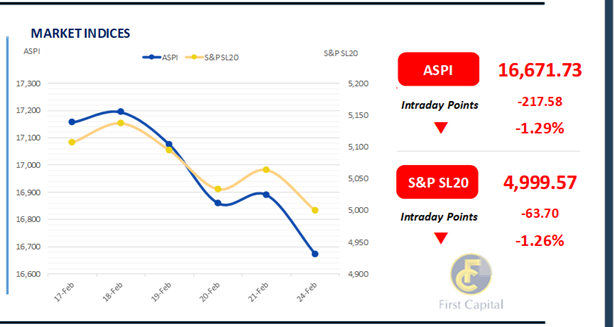

The Colombo Stock Exchange was gripped by heightened volatility today, amid subdued investor activity and lower volumes. The ASPI tumbled during the early hours of today’s trading session and remained subdued throughout the day though a few mild attempts at recovery were evident.

Consequently, the ASPI concluded the day in the red, at 16,672 denoting a downtick of nearly 218 points. The Banking sector exerted noteworthy adverse pressure on the ASPI with HNB, NDB, COMB and DFCC emerging as the top negative contributors alongside CFIN. SEMB, CSF and LLUB were the top positive contributors to the ASPI.

Turnover also followed suit, dwindling to LKR 2.1Bn from LKR 3.5Bn registered in the previous session. This marks a 61.2% dip from the monthly average of LKR 5.5Bn. It was the Banking sector that dominated contributions to turnover at 35%. This was followed by Capital Goods and the Food, Beverage and Tobacco sectors, which produced a joint contribution of 26%. Finally, foreign investors were net sellers amid dormant participation. The market registered a total outflow of LKR 5.4Mn.

Bond Market commences the week with thin volumes ahead of auctions

The secondary bond market yield curve commenced the week with limited activity and thin trading volumes. Mixed sentiment prevailed amidst some buying and selling interest ahead of the treasury bill and bond auctions, where LKR 27.5Bn is to be raised in T-Bonds at the auction scheduled for 27th Feb-25.

Amongst the traded maturities, notable trades were amongst the 2027, 2028, 2029, and 2030 maturities. On the short end of the curve, 01.05.27 traded at a rate of 9.20%. On the belly end of the curve, 15.02.28, 15.03.28, 01.05.28, and 01.07.28 traded at rates of 10.00%, 10.05%, 10.10%, and 10.22%, respectively. Similarly, the 15.09.29 maturity traded at a rate of 10.80%. 15.05.30, and 15.10.30 traded at rates of 11.00%, and 11.15%, respectively.

On the external front, the LKR appreciated against the USD, closing at LKR 295.9/USD compared to LKR 296.5/USD recorded the previous day. CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system expanded to LKR 159.65Bn from LKR 150.59Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..