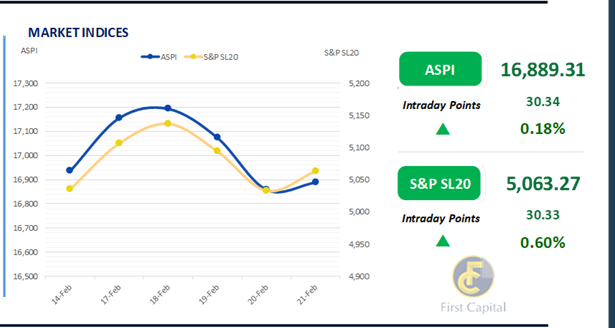

After two days of losses, the bourse rebounded with positive sentiment and low market activity, ending the day in the green. The ASPI closed the day in green at 16,889, gaining 30 points marking a 0.18% increase from the previous day.

During today's trading session, most of the investor attention was focused on Banking stocks. The most significant contributors towards the positive index were COMB, MELS, JKH, NDB, and SAMP.

The lack of crossings present in today’s market demonstrates decreased participation from both institutional and HNW investors. Additionally Banking sector stocks contributed significantly to the turnover, playing a key role in the overall market activity.

Meanwhile, turnover stood at LKR 3.5Bn, marking a decrease of 36.6%, from the monthly average. Moreover, the Banking sector led the turnover by 57%, followed by the Capital Goods, and Materials sectors jointly contributing 22% of the overall turnover. There was a net foreign outflow of LKR 749.8Mn.

Secondary bond market sees profit following three days of buying

The secondary market experienced a slight increase in rates amidst profit taking, leading to lower activity and moderate volumes in the secondary market. Meanwhile, CBSL announced a bond auction to be held on 27th Feb-25, where CBSL is planning to raise LKR 27.5Bn from two maturities under 15.06.29 and 15.12.32.

Amongst the traded maturities, in the short end 01.05.27 and 15.10.27 maturity traded at 9.20% and 9.44% respectively whilst 15.02.28, 15.03.28, 01.05.28, 01.07.28, 01.09.28 and 15.10.28 bond maturities traded at the rates of 10.02%, 10.04%, 10.12%, 10.25%, 10.30% and 10.34% respectively.

Meanwhile, 15.05.30 and 15.10.30 maturities traded at the rates of 11.00% and 11.13%. Additionally, towards the long end 01.12.31, 01.10.32 and 01.06.33 bonds traded at the rates of 11.37%, 11.45% and 11.46% respectively.

On the external front, the LKR appreciated against the USD, closing at LKR 296.48/USD compared to LKR 296.63/USD recorded the previous day. CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system contracted to LKR 150.6Bn from LKR 153.2Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..