The Colombo Stock Exchange experienced heightened volatility today, with the ASPI facing a steady decline throughout the session.

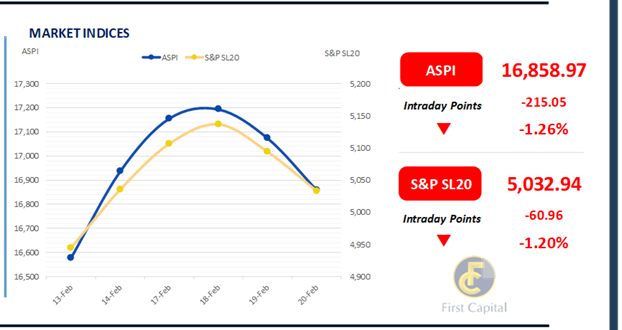

Despite a brief attempt at recovery towards the close, the index ultimately ended in negative territory, settling at 16,859, a drop of approximately 215 points.

The Banking sector was a primary driver of the downturn, with HNB, SAMP, and NDB among the leading negative contributors, alongside CINS and MELS.

Turnover dwindled to LKR 2.9Bn today, from LKR 3.7Bn that was registered yesterday. This also marked a dip of 49% from the monthly average of LKR 5.7Bn.

It was the Capital Goods sector that dominated contributions to turnover, at 30%. This was followed by the Banking sector and the Food, Beverage and Tobacco sector which produced a joint contribution of 38%.

Foreign investors turned net sellers amid somewhat high participation. Today’s session recorded a foreign outflow of LKR 381.0Mn.

In bond market foreign buying extends the buying stance for the 3rd consecutive session

Market participants in the secondary bond market continued their buying momentum for the third consecutive day, driven by strong foreign buying interest.

This resulted in high trading volumes and increased activity in the secondary market trades. Accordingly, the yield curve witnessed a decline from short to belly end of the curve.

Amongst the traded maturities, in the short end 01.05.27 maturity traded at 9.22% whilst 15.09.27 and 15.10.27 bonds traded at the range of 9.41% to 9.47%.

Meanwhile, both 15.02.28 and 15.03.28 maturities traded at 10.00%. Additionally, 15.09.28, 15.10.28 and 15.12.28 bonds traded at the range of 10.30% to 10.35%, whilst 15.09.29 traded at 10.75%. 15.10.30 maturity traded between 11.12% to 11.16%.

On the external front, the LKR depreciated against the USD, closing at LKR 296.63/USD compared to LKR 295.89/USD recorded the previous day. CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system contracted to LKR 153.2Bn from LKR 164.8Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..