The stock market experienced a day of volatility, starting off strong with positive sentiment and increased activity in the morning. However, by midday, a wave of profit taking caused the market to dip towards negative territory. Despite this, the market managed to recover by the close of the day.

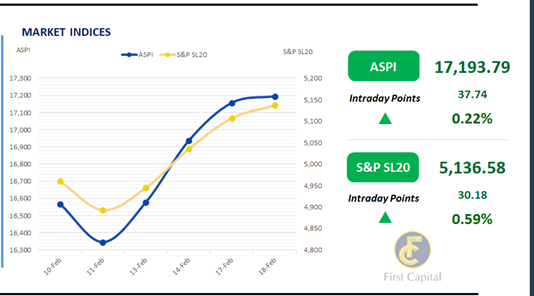

Amidst the increased participation from retail and HNW investors, ASPI closed the day in green at 17,194, gaining 38 points marking a 0.22% increase from the previous day. The most significant contributors towards the positive index were MELS, HNB, HHL, COMB, and SAMP.

Additionally, specific stocks in the Construction and Banking sectors, such as SIRA, AEL, and SAMP, continued to attract investor interest throughout the day. This was driven by positive expectations surrounding their upcoming quarterly results and dividend announcements.

Amidst multiple off-board transactions, turnover stood at LKR 5.5Bn marking a 4.7% decrease from the monthly average, where the Banking sector led turnover at 30%, followed by Diversified Financials and Capital Goods jointly contributing 38% of overall turnover. There was a net foreign outflow of LKR 92.9Mn.

Buying stance emerges, yield curve declines on short and mid tenors

Following the Budget 2025 announcement, the yield curve in the secondary bond market declined across the short and mid tenors, as investors adopted a buying stance.

This shift led to heightened trading volumes and increased market activity. Amongst the traded maturities at the short end 01.08.26 and 15.12.26 traded at the range of 8.65% to 8.85% whilst 01.05.27 traded between 9.40% to 9.30%.

Meanwhile, 15.09.27 maturity traded at 9.65% to 9.55%. At the mid end 15.02.28 and 15.03.28 maturities traded at the rate of 10.05% whilst both 01.05.28 and 01.07.28 traded between 10.14% to 10.27%. Furthermore, 15.10.28 and 15.12.28 traded between 10.33% to 10.42%.

2029 bond maturity 15.09.29 traded between 10.78% to 10.74% whilst 2030 maturity 15.10.30 traded between 11.21% to 11.17%. In the forex market, the LKR appreciated against the green bank and recorded at 295.3/USD compared to the 295.5/USD recorded previous day.

The CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system contracted to LKR 146.7Bn from LKR 159.7Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..