The bourse saw a day of positive sentiment and heightened momentum, supported by the improvement in investor confidence post unveiling of the maiden budget of the newly formed government. During today’s trading session, most of the investor attention was focused on Banking sector and Blue-chip stocks.

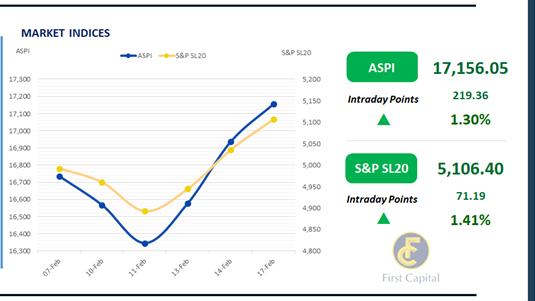

Amidst the increased participation from HNW investors, ASPI closed the day in green at 17,156, gaining 219 points and marking a 1.30% increase from the previous day. The most significant contributors to the positive index were CINS, MELS, NDB, SAMP, and HAYL. There was significant activity on CFVF and DIAL following the dividend announcement.

Meanwhile, turnover stood at LKR 5.4Bn marking a 4.9% decrease from the monthly average, where the Insurance sector led turnover at 19%, followed by Banking and Diversified Financials jointly contributing 37% of overall turnover. There was a net foreign inflow of LKR 777.4Mn.

Government unveils the 2025 budget: yield curve on standstill

The secondary market yield curve remained broadly unchanged while market participants were cautious on the inaugural budget speech of the new Government.

Market activities remained broadly stable with low volumes and limited trades. Amongst the traded maturities, short to mid end maturities, 01.05.27 and 15.02.28 traded at the rates of 9.45% to 10.08% whilst 01.05.28 traded at the range of 10.19% to 10.18%.

Furthermore, 15.09.29 traded at the rate of 10.80% and both 15.05.30 and 15.10.30 traded at the rates of 11.05% and 11.23% respectively. Additionally, during the week ending 14th Feb-25 the AWPR decreased by 17bps to 8.42% compared to the previous week.

CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system contracted to LKR 159.72Bn from LKR 175.09Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..