Today the Colombo Stock Exchange witnessed further revival as the ASPI concluded in the green alongside improved trading volumes and investor participation.

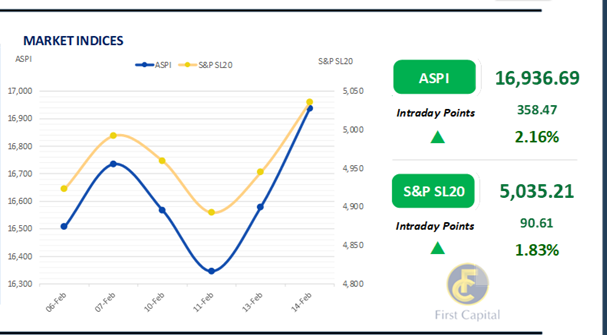

The ASPI stood at 16,937 having secured a jump of 358 points compared to yesterday. Amid some volatility particularly during the early trading hours, the ASPI registered a consistent uptick throughout the day.

CINS, MELS, HAYL, CFIN and JKH stood out as the top positive contributors to the ASPI. On the flip side, LION, MGT and MAL emerged as the top negative contributors to the ASPI.

Market turnover rose to LKR 4.9Bn from LKR 3.6Bn that was registered yesterday, inching closer to the monthly average of LKR 5.7Bn. The Banking sector dominated turnover contributions with a share of 21%. The Capital Goods segment followed closely alongside the Food, Beverage, and Tobacco sector, which collectively accounted for 35% of total turnover.

Market activity rises but yields hold their ground

The Central Bank of Sri Lanka has announced a T-Bill auction totaling LKR 115.0Bn, scheduled for 19th Feb-25. CBSL aims to raise LKR 25.0Bn from 3M, LKR 60.0Bn from 6M, and LKR 30.0Bn from 12M T-Bills respectively. Today, the secondary market experienced a volatile trading session, marked by strong buying interest among market participants.

As a result, secondary market trades witnessed high trading volumes, however the yield curve remained broadly unchanged. Amongst the traded maturities, 2026 bond maturities traded in the range of 8.95% to 8.40% whilst 2027 bond maturities traded in the range of 9.45% to 9.40%.

Investor interest predominantly focused on 2028 maturities. Accordingly, 15.02.28 traded in the range of 10.12% to 10.08%, 15.03.28 maturity traded in the range of 10.12% to 10.10%, 01.05.28 maturity traded in the range of 10.20% to 10.18%, 01.07.28 maturity in between 10.30% to 10.25% whilst 15.10.28 maturity in the range of 10.38% t0 10.35%.

Furthermore, at the mid end, 15.09.29, 15.05.30 and 15.10.30 traded at 10.80%, 11.05% and 11.25% respectively. Meanwhile, 15.05,31, 01.07.32 and 01.10.32 traded at the rates of 11.43%, 11.48% and 11.485% respectively. On the external front, the LKR was further appreciated against the USD, closing at LKR 296.56/USD compared to LKR 297.02/USD recorded the previous Tuesday.

CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system expanded to LKR 175.09Bn from LKR 171.55Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..