Today the Colombo Stock Exchange shrugged off the lethargy that was evident across the last two sessions, gaining momentum and ending the day in the green.

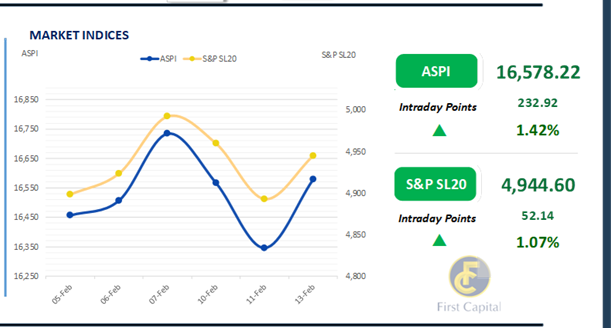

Despite an initial dip that was seen in the early hours of today the ASPI persistently inched upwards amid mild volatility that was present across today’s session.

The ASPI concluded the day at 16,578, having gained nearly 233 points compared to the last trading session. This turnaround was also supported by greater investor participation and heightened trading activity.

CINS, CFIN, SAMP, LOLC and NDB emerged as the top positive contributors to the ASPI. On the flip side, CTC, HNB and SPEN exerted noteworthy adverse pressure on the ASPI.

Market turnover rose to LKR 3.6Bn from LKR 2.4Bn recorded in the last trading session. While this is still lower than the monthly average of LKR 5.7Bn, turnover appears to have consistently increased this week.

The Consumer Durables segment dominated turnover contributions with a 26% share. This was followed by Capital Goods, and the Banking sectors, which collectively accounted for 32% of total turnover.

Buying interest rises following the T-Bond auction

Today’s bond auction saw increased levels of demand and buying interest on both 2028 and 2029 maturities, as the Central Bank of Sri Lanka raised a total of LKR 67.5Bn. 2028 maturity was fully accepted where LKR 37.5Bn was accepted from total bids received of LKR 78.8Bn and the 01.09.2028 bond closed at a weighted average yield rate of 10.31%. LKR 30.0Bn was accepted from the total bids received amount of LKR 107.2Bn on the 2030 maturity.

The 15.10.2030 bond accepted at a weighted average yield rate of 11.23%. Following the bond auction, buying interest increased in the secondary market, which saw moderate volumes and heightened activity.

On the traded maturities at the short end 15.05.27 traded at the range of 9.45% to 9.40% whilst both 15.09.27 and 15.10.27 traded at the range of 10.75% to 10.70%. Towards the belly end of the curve, 15.02.28 and 15.03.28 traded at the range of 10.15% to 10.10% whilst 01.05.28 traded between 10.23% to 10.17%.

Meanwhile, all 01.07.28, 15.09.28, 15.10.28 and 15.12.28 traded at the range of 10.45% to 10.30%. 5-year bond, 15.09.29 traded in the range of 10.85% to 10.80% whilst both 15.05.30 and 15.10.30 traded in the range of 11.20% to 11.05%. On the external front, the LKR appreciated against the USD, closing at LKR 297.02/USD compared to LKR 297.52/USD recorded the previous Tuesday.

CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system expanded to LKR 171.55Bn from LKR 163.50Bn recorded the previous day.

Courtesy: First Capital research

Subscribe to our newsletter to get notification about new updates, information, etc..