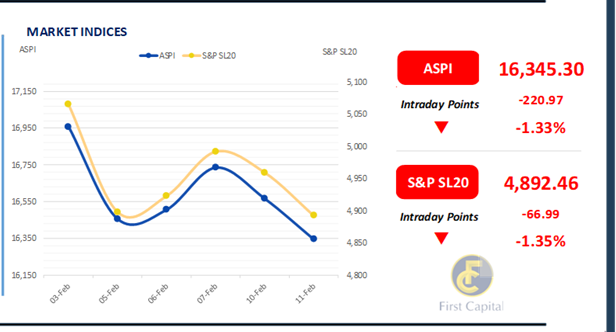

The Colombo Stock Exchange extended its decline for the second consecutive session, with the ASPI experiencing sustained downward pressure throughout the day.

The index trended lower during the morning session, and despite a brief attempt at recovery by midday, it remained well below the previous day's closing level.

The ASPI closed at 16,345, recording a decline of 221 points. The number of negative contributors increased compared to the previous session, with the Banking sector exerting the most downward pressure.

HNB, SAMP, DFCC, MELS, and COMB were the primary negative contributors. In contrast, CTC, RICH, and COOP emerged as the top positive contributors.

Market turnover showed a modest improvement, rising to LKR 2.4Bn from LKR 2.1Bn in the previous session. However, it remained significantly below the monthly average of LKR 5.9Bn.

The Banking sector led turnover contributions with a 29% share, followed by the Capital Goods, and Food, Beverage & Tobacco sectors, which collectively accounted for 26% of total turnover.

T-Bill auction yields decline for 10th consecutive week

Today’s Treasury Bill auction saw a decline in rates across the board for the 10th consecutive week. The CBSL raised a total of LKR 157.5Bn with the total offered amount being fully accepted, where the 03M and 06M T-Bills were oversubscribed, while the 12M T-bill was undersubscribed.

The 03M T-Bill was accepted at LKR 44.1Bn, the 06M T-Bill was accepted at LKR 83.4Bn, and the 12M T-Bill was accepted at LKR 30.0Bn.

The weighted average yield rates saw declines, where the 03M bill saw a decline of 10bps at 7.69%, the 06M bill saw a decline of 6bps at 7.94%, and the 12M bill saw a decline of 1bps at 8.42%.

The secondary market yield curve experienced some buying interest on the short to mid end of the curve, with notable trades amongst the 2027, 2028, 2029, 2030, and 2032 maturities. On the short end of the curve, 01.05.27, and 15.12.27 traded at rates of 9.50%, and 9.85%, respectively.

On the belly end of the curve, 15.02.28, 15.03.28, 01.05.28, 01.07.28, and 15.10.28, traded at rates of 10.10%, 10.13%, 10.25%, 10.34%, and 10.40%, respectively. 15.09.29, 15.05.30, 15.10.30, and 01.07.32 traded at rates of 10.87%, 11.05%, 11.26%, and 11.48%, respectively.

On the external front, the LKR appreciated against the USD, closing at LKR 297.5/USD compared to LKR 297.7/USD recorded the previous day. CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today.

Overnight liquidity in the banking system expanded to LKR 163.50Bn from LKR 153.52Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..