Trading activity at the Colombo Stock Exchange showed a subdued performance today, with the market experiencing a mix of early optimism followed by persistent volatility and a general downward trend as the session wore on.

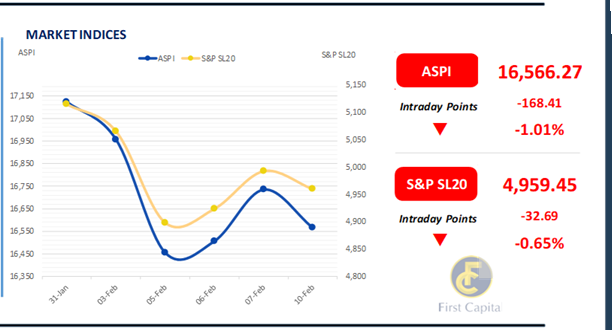

The ASPI closed in the red at 16,566, marking a decline of 168 points and ending the positive two-day streak. CINS, LOLC, and JKH were the main negative contributors, exerting downward pressure on the index.

On the flip side, SAMP, GUAR, and VONE helped prop up the market as the top positive contributors. Notably, the number of negative contributors was nearly three times that of the positive ones.

Turnover remained relatively low, amounting to LKR 2.1Bn. While this was slightly higher than the previous session, it still fell below the monthly average of LKR 5.9Bn.

In terms of sectoral turnover contributions, the Banking sector led with a 29% share, followed closely by the combined contributions of the Capital Goods, and Food, Beverage & Tobacco sectors, which accounted for 33% of total turnover.

Thin volumes emerge ahead of upcoming auction

The secondary market yield curve commenced the week with limited activity and thin trading volumes. The CBSL announced the issuance of LKR 67.5Bn in treasury bonds in an auction scheduled to be held on 13th Feb-25, where LKR 37.5Bn is to be raised for the 01.09.28 maturity, and LKR 30.0Bn is to be raised for the 15.10.30 maturity.

Amongst the traded maturities, notable trades were amongst the 2028, 2030, and 2032 maturities. On the belly end of the curve, 15.02.28, and 15.03.28 traded at a rate of 10.15%, while 01.07.28 traded at a rate of 10.38%, and 15.10.28 traded at a rate of 10.40%.

Similarly, the 15.05.30 maturity traded at a rate of 11.09%, and 01.07.32 traded at a rate of 11.48%. On the external front, the LKR appreciated against the USD closing at LKR 297.7/USD compared to LKR 298.5/USD recorded the previous day.

CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system expanded to LKR 153.52Bn from LKR 144.29Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..