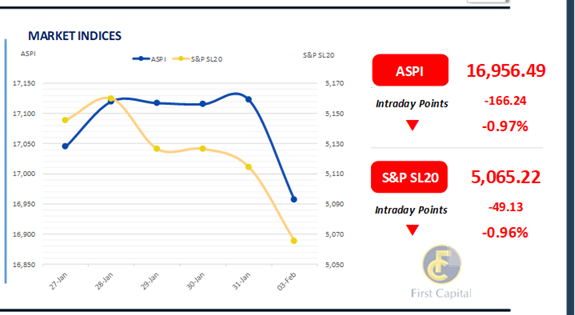

The ASPI closed the first trading session of February at 16,956, down 166 points. Negative contributors outpaced positive ones, with key decliners including HNB, LOLC, BUKI, CARS, and CFIN.

On the upside, SPEN, TJL, and CCS were notable performers. SPEN’s growth was driven by strong January tourist arrivals and a positive outlook for the tourism sector

.

TJL and CCS benefitted from robust earnings reports. Market turnover totaled LKR 3.0Bn, a 57.0% decline from the monthly average of LKR 7.1Bn.

The Capital Goods sector led turnover at 26%, followed by the Food, Beverage & Tobacco and Banking sectors which contributed 29%.

There was notable activity in the Apparel and Construction sectors. Investor participation remained subdued among HNW individuals, while retail investors remained dominant. Foreign investors were net sellers, with a net outflow of LKR 179.3Mn.

Moderate volumes and limited activity persist ahead of auction

The secondary bond market yield curve experienced limited activity and below moderate trading volumes. Some selling pressure emerged ahead of the T-Bill auction to be held on 5th Feb-25, where the CBSL is scheduled to raise LKR 180.0Bn in T-Bills, from which LKR 30.0Bn is to be raised from the 91-day bill, LKR 60.0Bn is to be raised from the 182-day bill, and LKR 90.0bn is to be raised from the 364-day bill.

Amongst the traded maturities, notable trades were amongst the 2027, 2028, and 2031 maturities. On the short end of the curve, 01.05.27, and 15.10.27 traded at rates of 9.60%, and 9.80%, respectively.

On the belly end of the curve, 15.03.28, and 01.05.28 traded at rates of 10.20%, 10.30%, respectively, while 01.07.28, and 15.10.28 traded between 10.40% - 10.43%.

Similarly, the 01.12.31 maturity traded at a rate of 11.40%. On the external front, the LKR depreciated slightly against the USD closing at LKR 297.64/USD compared to LKR 297.58/USD recorded the previous day.

CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system expanded to LKR 184.95Bn from LKR 161.96Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..