During the week’s closing, investors displayed mixed sentiment following several bullish sessions leading to a slight dip in the index during the early hours of trading.

However, the index began to recover around midday, boosted by heightened participation from HNW investors, particularly through an off-board transaction involving the CDB.

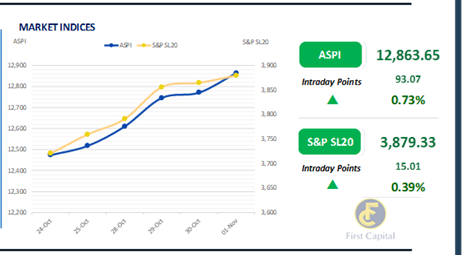

Accordingly, ASPI closed the day at 12,864 gaining 93 points. Additionally, investors remained optimistic towards mid and small-cap Banks like PABC and DFCC, as well as selected NBFIs. MELS, HNB, RICH, LOLC, and CFIN emerged as the top positive contributors to the index.

Meanwhile, amidst multiple crossings, turnover stood at LKR 5.0Bn, marking over an 81.0% increase monthly average standing at LKR 2.7Bn. Out of 5 off-board transactions, notable trade was recorded on CDB, trading a 14.9% stake at LKR 247.5/share through an off-board transaction.

The Diversified Financials sector led turnover by 52%, followed by the Banking and Capital Goods sectors jointly contributing 31% of the overall turnover. Foreign investors turned net buyers, with a net inflow of LKR 10.0Mn.

Yield curve remains fixed amidst dull bond market activity

The secondary bond market yield curve remained unchanged amidst a notable lack of activity in the market. Investors adopted a cautious wait-and-see stance, reflecting dull sentiment and limited participation.

This prevailing hesitance was further emphasized by an absence of notable trades, as investors seemed reluctant to engage in new positions.

Meanwhile, on the external front, the LKR appreciated against the USD, closing at LKR 293.4/USD, compared to LKR 293.7/USD recorded the previous day.

Similarly, the LKR also appreciated against the GBP, closing at LKR 378.3/GBP compared to LKR 382.1/GBP recorded the previous day. Conversely, the LKR depreciated against other major currencies including the EUR, AUD, CNY, and JPY. CBSL holdings of government securities remained unchanged, closing at LKR 2,515.62Bn today.

Overnight liquidity in the banking system contracted to LKR 140.05Bn from LKR 179.46Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..