After two consecutive sessions of gains, the broad market experienced sideways movement as investors booked profits primarily in the Banking sector counters.

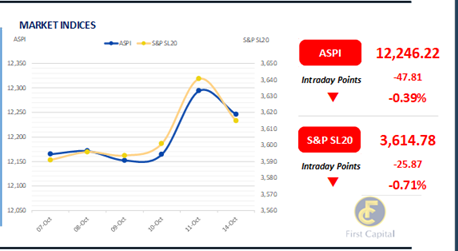

The ASPI closed the session in red at 12,246, losing 48 points. Despite this, investors maintained a positive sentiment towards the Plantation and Apparel sector counters, with a surge of interest in HELA and MGT emerging in the market.

CTHR, HNB, COMB, SAMP, and NDB emerged as the top negative contributors to the index. In contrast to previous sessions, the market saw a decrease in participation from HNW investors, while retail investors remained actively engaged.

Accordingly, turnover stood at LKR 1.5Bn, marking a 30.5% decrease from the monthly average standing at LKR 2.1Bn. Furthermore, 24% of the overall turnover was contributed by the Food, Beverage, and Tobacco sector whilst 37% of the turnover was jointly contributed by the Capital Goods and Consumer Durables sectors.

Notably, foreign investors remained net buyers for the fourth consecutive session with a net foreign inflow of LKR 153.6Mn on the back of strong foreign buying interest on JKH with a foreign inflow of LKR 128.0Mn.

Mid tenors edge low as buying strengthens

The secondary market yield curved edged down on the belly of the curve, as mid tenors continued to attract interest during the day while long tenors did not trade mostly.

2027 and 2028 mid tenors witnessed higher demand resulting in a 10-15bps decline at today’s trading session. Accordingly, 2027 maturities; 01.05.2027, 15.12.2027 and 15.09.2027 registered transactions at 11.20%.

Several maturities from the 2028 tenors also observed trades. Accordingly, 15.02.2028 and 15.03.2028 closed trades at 11.45% whilst 01.05.2028 and 01.07.2028 closed trades at 11.50%.

Moreover, 15.12.2028 too registered trades at today’s session at 11.63%. Meanwhile, 15.09.2029 and 15.05.2030 also witnessed buying at 11.70% and 12.00%, respectively.

On the external side, LKR appreciated against the greenback, closing at LKR 292.9/USD compared to previous day’s closing of LKR 293.1/USD. Similarly, rupee appreciated against other major currencies including the GBP, EUR, JPY, and AUD.

Meanwhile, overnight liquidity closed at LKR 165.31Bn and CBSL Holdings remained stagnant at LKR 2,515.6Bn. AWPR for week ending 11th October saw an uptick of 12bps, registering at 9.25% compared to previous week’s closing of 9.13%.

Moreover, foreign held outstanding stock of government securities inclined by 15.6%WoW, indicating a positive momentum in foreign interest.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..