The Colombo Bourse struggled to maintain the momentum of the previous week, with both indices closing the day in red.

Banking sector companies and conglomerates dragged the indices down steeply amidst the uncertainties surrounding the upcoming election.

Notably, COMB experienced selling pressure ahead of tomorrow – the final day of the renunciation of its rights shares, leading to a 27-point drop in the ASPI.

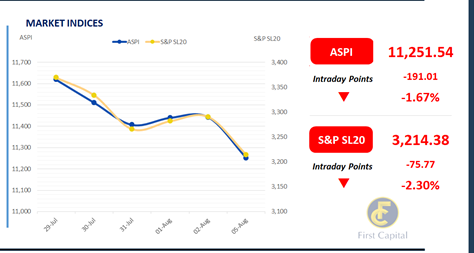

Meanwhile, all most every sector witnessed price declines across the board. Consequently, ASPI halted the day in red at 11,252 plummeting to over 4-month low, losing 191 points marking the year to date second highest loss.

With the mixed participation from the HNWIs and retail investors, turnover stood at LKR 863.9Mn, marking a 13.8% decrease from the monthly average standing at LKR 1.0Bn.

Food, Beverage and Tobacco sector contributed 26% to the turnover, followed by the Capital Goods and Banking sectors jointly contributing 39% to the overall turnover. Foreign investors remained net buyers, with a net inflow of LKR 8.9Mn.

Yield curve ticks slightly high in bod market

The secondary market yield curve slightly edged up on the belly as selling pressure emerged on the mid tenors amidst moderate volumes.

Broadly, investor sentiment remained mixed but selling pressure was observed on the mid tenors such as 2028, 2029 and 2030.

Accordingly, 01.07.2028 closed transactions at 12.40% while 15.09.2029 observed trades at 12.45%. Meanwhile, 15.10.2030 registered trades at 12.80% level during the day.

Investors continued to maintain a cautious stance amidst the growing uncertainty evolving in the political landscape given the upcoming elections.

On the external side, LKR appreciated against the USD closing at LKR 302.1. However, against other major currencies including GBP, EUR and JPY, Sri Lankan rupee depreciated during the day.

AWPR for the week ending 02nd Aug-24 inched up by 23 bps to 9.04% compared to the previous week displaying volatility.

Meanwhile, Foreign holding of government securities remained broadly unchanged with only a marginal decline of 0.03% to LKR 52.0Bn for the week ending 01st Aug-24.

Meanwhile, overnight excess liquidity remained high at LKR 99.5Bn whilst CBSL holdings remained stagnant at LKR 2,575.6Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..