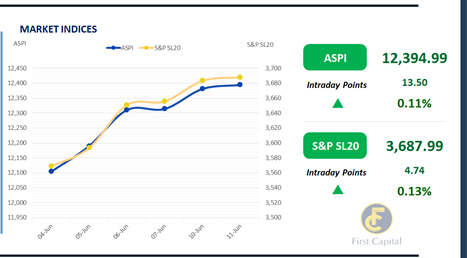

Colombo bourse continued its upward trajectory for the 6th consecutive day, amidst improved buying interest enticed across holding companies and banks while participation of retail investors and HNWIs remained active.

HAYL, SUN, BIL, DIPD and VONE emerged as significant contributors to the index. Despite starting the day on a bullish note, market sentiment turned bearish as the session progressed in the latter part. Nonetheless, the index concluded the day in green, closing at 13,395 gaining 14 points.

Turnover witnessed a significant improvement reaching nearly a one and half month high at LKR 3.7Bn, reflecting a 151.9% rise from the monthly average standing at LKR 1.5Bn. Notably, HAYL contributed 28.3% to the overall turnover.

The Capital Goods sector led the turnover at 52.4%, with the Food, Beverage and Tobacco and Banking sectors jointly contributing 24.2% to the overall turnover. Foreign investors remained net sellers while reaching a one month low, recording a net outflow of LKR 166.9Mn.

Bond yields on the rise ahead of the anticipated T-Bond auction

The secondary market witnessed moderate volumes resulting in bond yield across the board to surge during the day as a result of the LKR 295.0Bn treasury bond announcement yesterday, pivoting from the wait and see approach displayed during the previous session due to the surrounding uncertainty regarding the IMF review which is scheduled for the 12th Jun-24.

Moreover, liquid maturities enticed trades during the day namely, 01.07.25 traded at 9.80%, 15.05.26 traded at 10.05%, 15.12.26 traded at 10.15% and 15.09.27 traded at 10.75%. Furthermore, towards the mid end of the curve 15.01.28 along with 15.03.28 tenors traded at 11.00%, 01.05.28 traded at 11.10% while 01.09.28 traded at 11.25%.

Towards the long end of the curve 15.05.30 and 01.10.32 tenors changed hands at 11.90% and 12.12%, respectively. On the external side LKR slightly depreciated against the USD recording at LKR 303.0. Overnight liquidity registered at LKR 157.8Bn whilst CBSL Holdings remained stagnant at LKR 2,615.6.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..