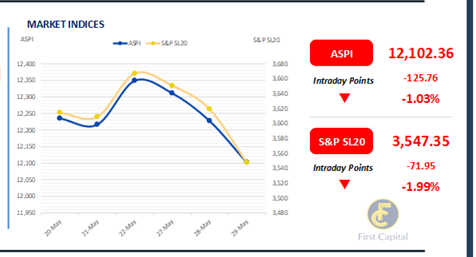

The bourse experienced another day of negative sentiment and uncertainty. The ASPI closed at 12,102, falling to its lowest levels in the last month, marking a 1.03% decrease from the previous day, to which the most significant negative contributors were banks, predominantly COMB, DFCC, HNB, and NDB, where COMB contributed the most negatively to ASPI, reflecting unfavorable activity in the market, particularly in the banking sector following the news of the Commercial Bank rights issue.

In contrast, SPEN, CARG, ASPH, and AHUN contributed positively to ASPI, where SPEN and CARG led the way. Increased selling activity took place in the market, further reflecting the low investor sentiment and skepticism in the market.

Turnover saw an increase, standing at LKR 1.0Bn with a 14.6% increase from the previous day, where the Banking sector led turnover at 51%, followed by the Food, Beverage and Tobacco, and Capital Goods sectors jointly contributing to 21% of overall turnover, further exhibiting heightened selling activity and negative sentiment within the banking sector.

There was a net foreign outflow of LKR 24.5Mn signaling interest in outward investments. The market overall experienced a day of significant uncertainty and low sentiment triggered by drawbacks in the banking sector.

Auction yields continue to decline for the 8th consecutive week

The secondary market witnessed buying sentiment throughout the day, largely centered on the shorter and the belly end of the curve.

Thus, trades were observed on the 2026 maturity, with 15.05.26, 01.06.26, 01.08.26 and 15.12.26 trading between 9.93%- 9.70%. Furthermore, a steep decline in yields was also observed at the LKR 160.0Bn Treasury bill auction held today, with yields dropping by more than 10bps across the board and continued to hover below the 10% mark.

The LKR 160.0Bn auction conducted today was fully subscribed with CBSL raising LKR 30.0Bn from the 3M bill at 8.62% (-14bpsWoW), LKR 50.0Bn from the 6M bill at 9.04% (-13bpsWoW) and raising LKR 80.0Bn from the 364-day bill at 9.18% (-11bpsWoW).

Meanwhile, post auction selective interest was visible on the tail end of the curve, with 15.09.27 trading between 10.55%-10.35% whilst 2028 maturities including 15.03.28, 01.05.28 and 01.07.28 maturities trading between 10.90%-10.70%.

Furthermore, few trades were also enticed on the 01.10.32 maturity, trading at 11.85%. Meanwhile, on the external front, LKR continued to remain volatile and depreciated for the fourth straight session and recorded at LKR 301.27/dollar

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..