The market saw negative sentiment and slow activity at the beginning of the day, gradually experiencing increased momentum and positive investor sentiment after mid-day.

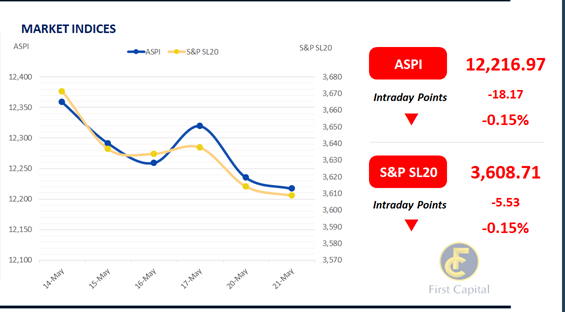

The ASPI closed at 12,217, exhibiting a 0.15% decrease from the previous day reflecting the downward trends of the past few days, to which the most significant negative contributors were CTC, DIAL, and LIOC.

In contrast, JKH, LOLC, CCS, ASPH, and CFIN were the dominant positive contributors to the index, where JKH and LOLC led the way. Increased buying activity began by mid-day, where investors displayed interest in a variety of sectors, notably the Capitals Goods, Banking, and Food, Beverage and Tobacco sectors, while interest in HNW firms remained low.

Turnover saw an increase, reflecting positive sentiment in the market in the second half of the day, standing at LKR 1.3Bn with a 20.4% increase from the previous day, where the Capital Goods sector led turnover at 35%, followed by the Food, Beverage and Tobacco, and Energy sectors jointly contributing to 26% of overall turnover.

There was a net foreign inflow of LKR 97.5Mn signaling interest in local investments. The market overall experienced a day of gentle gains towards the latter part of the day, signaling a slight recovery from negative investor sentiment.

3M T-Bill dips below 9.00%

The secondary bond market witnessed a shift in momentum, with buying interest emerging across the short to mid tenors. Investor interest was notably witnessed on liquid tenors, mainly, 2026 maturities, including 15.05.26, 01.06.26, 01.08.26, and 15.12.26, traded within the range of 10.20% to 10.00%, while 15.09.27 traded at 10.32%.

Additionally, 2028 maturities, such as 15.03.28, 01.05.28, 01.07.28, and 15.12.28, attracted buying sentiment, trading between 10.60% to 10.75%. Mid-end maturities including 15.05.30 and 15.10.30 transacted between 11.65% to 11.60%, while the tail-end maturity of 01.10.32 traded lower between 11.90% to 11.85%.

Moreover, at the LKR 160.0Bn T-Bill auction, total offerings were fully accepted, leading to a decline in the WAYR across all tenors. Accordingly, 3M bill dropped below 9.00% and was accepted at 8.76% (-28bps), while the 6M and 1Yr T-Bills closed at 9.17% (-26bps) and 9.29% (-28bps), respectively. On the external side, LKR remained broadly stable against the greenback closing the day at LKR 299.83/USD.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..