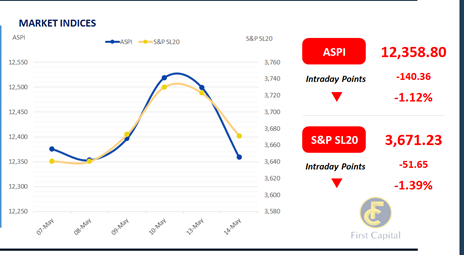

The bourse extended the bearish momentum for the second consecutive day with ASPI closing at 12,359 losing 140 points (c. -1.12%). This decline was particularly influenced by the selling pressure observed on the Banking sector counters like COMB and HNB, as well as index heavy weights such as JKH and LOLC.

Furthermore, there was notable buying interest in CTC and LLUB, driven by the recently disclosed earnings reports indicating a substantial upsurge in both revenue and earnings.

Meanwhile the turnover witnessed a significant increase during the day, totaling LKR 3.3Bn making a 32.7% increase from the monthly average of LKR 2.5Bn. This uptick was attributed to active participation from both retail investors and HNWI.

Capital Goods sector led turnover at 39%, followed by the Banking and Food, Beverage and Tobacco sectors jointly contributing to 31% of overall turnover. Additionally, interest in the Construction sector was also observed. Foreign investors remained net sellers, recording a net outflow of LKR 587.8Mn

.

Bullish sentiment further drives down bond yields

The secondary market yield curve further declined as bullish sentiment continued to drive heavy buying momentum in the secondary market. Investor interest enticed across the board, with 2026 tenors trading within the range of 10.15% to 10.00%.

Meanwhile, yields of 01.05.27, 15.09.27, 15.03.28, 01.05.28, and 01.07.28 traded at the lowest at 10.20%, 10.25%, 10.60%, 10.65%, and 10.66% respectively. Meanwhile, on the long end of the curve, yields further decreased to 11.50% and 11.80% for the 15.05.30 and 01.10.32 maturities.

Moreover, CBSL announced an issue of LKR 177.5Bn T-Bills through an auction to be held on 15th May 2024, out of which LKR 45.0Bn is to be raised from 91-day maturity, LKR 77.5Bn is expected to be raised from 182-day maturity while LKR 55.0Bn is to be raised from 364-day maturity. On the external side, LKR slightly depreciated against the greenback and recorded at LKR 299.90/USD.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..