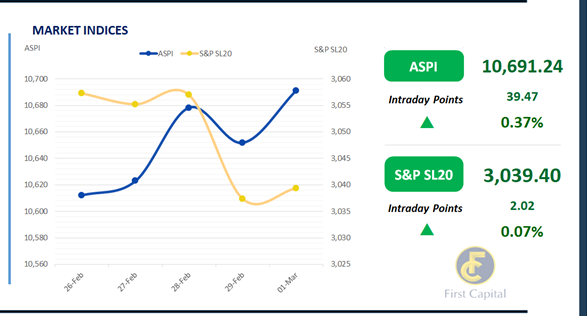

The Colombo stock market closed in the green, despite a mixed sentiment been observed in today's market. ASPI stayed stagnant for the majority of today’s session but picked towards the latter part of the session ending at a 39 point increase to 10,691.

Aside from HNB, banking sector counters saw a selling pressure emerging in today's session. UAL and CTC saw an increased interest which resulted in a 6.6% and 1.9% price appreciation respectively following their dividend announcements.

Further, a mixed sentiment was observed on blue chip counters. The largest positive contributors to the index were HNB, CARG & MELS whilst the largest negative contributors were COMB, DFCC & JKH. . Market turnover was recorded at LKR 1.5Bn, 6% lower than the average market turnover of LKR 1.6Bn.

Majority of the market turnover was contributed by the retail market, showing a revival in investors' interest in the Colombo Bourse. Foreign investors remained net sellers with a net foreign outflow of LKR 149.8Mn.

The secondary bond market continues its dull stance

The secondary bond market yield curve remained broadly unchanged during the day continuing the sluggish movement from the previous session.

The investors further continued to adapt into a cautious stance displaying very limited activity followed by low volumes. However, short and mid end maturities enticed trades during the day as 15.09.27 tenor traded at 11.95%, 15.03.28 tenor traded at 12.20% and 01.07.28 maturity traded at 12.22%. on the external side LKR slightly appreciated against the green back recording at LKR 309.9.

Moreover, overnight liquidity turned positive after 4 consecutive sessions whilst CBSL holdings of government securities remained stagnant at LKR 2715.6Bn. On the external sector performance review for the month of January 2024, the trade deficit recorded an expansion to USD 541.0Mn cf. USD 445.0Mn mainly due to higher import expenditure.

Meanwhile Worker remittances too displayed an improvement registering at USD 488.0Mn whilst tourism earnings registered at USD 342.0Mn witnessing a substantial increase of 122.7%YoY compared to the previous year.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..