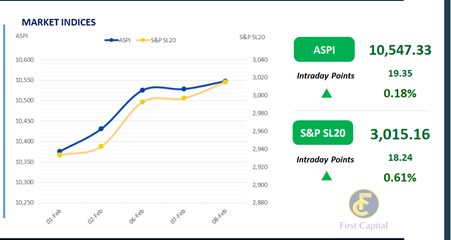

The bourse ended in the green for the 7th consecutive session with a 19 point increase as investor participation increases. ASPI peaked at the start of session and maintained that position throughout the rest of the day, ending the day at 10,547 as increased buying interest was observed on banking and blue chip counters, with HAYL, DFCC and HHL being a few of the largest contributors.

With the further fall in the yield rates of bills and bonds, primary dealer counters such as CALT saw keen buying interest. Turnover was recorded at LKR 1.1Bn which is 19% lower than the average monthly turnover of LKR 1.3Bn, however a relatively large retail presence was observed today as more investors were participating in the market following yesterday's 2 year high turnover of LKR 12.2Bn. Foreign investors remained net sellers today with a net foreign outflow of LKR 120.0Mn.

Intense Bull Run drives yields to new lows

Strong bullish sentiment extended to yet another day, as the secondary market adjusted downwards for the 5th consecutive session with investor interest spanning across mid tenors. Accordingly, 2025 maturity observed trades at 11.00% while 2027 and 2028 maturities enticed trades at 11.75% and 12.00%, respectively. It is noteworthy that buying sentiment continued to persist despite CBSL’s announcement on the relaxation of restrictions on the Standing Facilities to LCBs, following a review of market developments and improved liquidity condition. Accordingly, effective from 16-Feb-24, the restriction on the Standing Lending Facility (SLF) will be lifted, and the limit on access to Standing Deposit Facility (SDF) access will double from 5 times per month to 10 times per month. Meanwhile, CBSL has announced the issue of LKR 55.0Bn worth bond auction scheduled on 13 -Feb-2024. Meanwhile, on the external side, LKR appreciated against the USD and closed at LKR 313.2

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..