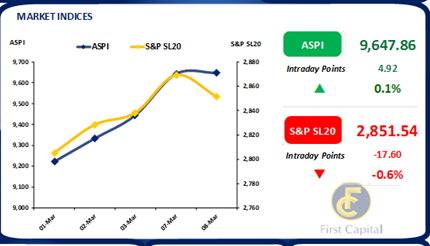

After the significant gain recorded during the past four sessions (up by 454 points), ASPI closed the day flat as profit-taking emerged during the day mainly on SAMP and index heavyweights, while retailers remained on the sidelines awaiting for a clear direction on the interest rates from the weekly bill auction.

Index rallied with a substantial gain reaching an intraday high of 9,774 during the early hours of trading. However, selling pressure emerged by mid-day, which wiped off most of the gains as retailers chose to book profits and adopt a cautious stance after the index breached the psychological barrier of 9,700.

Accordingly, index closed the day flat at 9,648, gaining 5 points. High net worth and Institutional investors’ participation continued on Blue chip companies and Banks with the expectation on the IMF board level agreement to be inked by Mar 2023. Turnover continued to record at LKR 3.3Bn (+79% cf. monthly average turnover of LKR 1.8Bn) and was continued to be dominated by Capital Goods and Banking sectors with a joint contribution of 57%.

Bill auction fully subscribed; Buying interest brings down secondary market yields

CBSL conducted its weekly bill auction and fully accepted the issued LKR 85.0Bn. With renewed optimism on possible signing of the IMF board level approval, yields fell across the board on all 3 maturities, with 12-months recording sharpest drop of 121bps to 26.43% whilst 3-months and 6-month yields slid down by 84bps to 28.75% and 87bps to 27.77% respectively.

Meanwhile on the secondary market, buying interest was visible throughout the day with moderate volumes, as 01.06.25 and 01.07.25 maturities traded between 31.25%-29.75%. Moreover, two-way quotes on 15.09.27 maturity also fell during the day with trades taking place between 27.20%-26.30%.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..