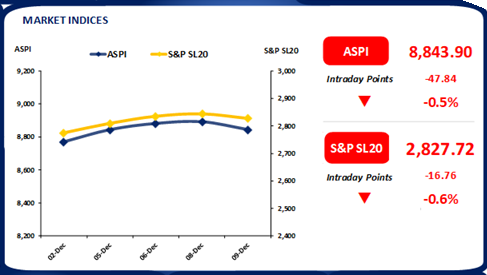

Bourse regressed to red ending the 9-day winning streak as investors resorted to book profits in blue chip counters. Index witnessed a slight upscale during the initial hour with perceptible interest on LIOC following the dip in global crude oil prices.

Subsequently, the positive momentum hampered as investors reverted to a selling spree especially on JKH, SPEN and COMB and closed for the day at 8,844 losing 48 points.

Meanwhile, overall turnover plunged sharply as it fell 33% below yesterday’s turnover level and recorded at LKR 1.6Bn (-18% cf. monthly average turnover of LKR 2.0Bn) with Energy and Transportation sectors leading the overall turnover with a joint contribution of 53%.

Bond yields inch high amidst thin volumes

The secondary bond market yield curve inched higher across the bond maturities as investors adopted a wait and see approach following the CBSL’s announcement on the largest value issue of T-Bonds in the year amounting to LKR 160.0Bn through an auction to be held on 13th Dec 2022.

Although the overall market recorded limited activities and thin volumes, slight investor interest was witnessed on 01.05.24 maturity which was traded within the range of 32.00%-32.10% while short-term bills hovered between 27.00%-29.00% during the day

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..