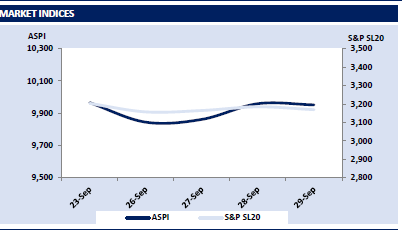

ASPI closed the day flat as investors chose to be on the sidelines awaiting direction on interest rates from the upcoming policy review meeting scheduled for 06th Oct 2022.

In response to that, index plunged significantly and displayed sizable volatility throughout the session before closing the day at 9,951, losing 7 points. Profit taking was witnessed predominantly on Transportation (mainly EXPO) and Energy sector counters yet persistent rally on Capital goods sector (mainly Tiles) partly offset the losses.

Turnover improved to LKR 3.4Bn (-19% cf. monthly average turnover of LKR 4.2Bn) largely led by Materials and Capital Goods sectors with a joint contribution of 47%. Meanwhile, off-board transactions of mainly LOFC, LIOC and JKH contributed 10% to the market turnover.

Auction yields mount up over 30.0%; long tenor attracts interest

At the primary bond auction today, Yield across all maturities crossed the 30.0% level with 01.07.25 maturity closing at a weighted average yield rate of 30.95% amidst a relatively low acceptance level of 63.8% while 15.01.28 maturity closed at a weighted average yield rate of 31.50% with a 90.9% acceptance.

However, long tenor maturity 01.07.32 witnessed greater investor interest with bids recording above 100% of the offer and was accepted fully at a weighted yield rate of 30.09%. Following higher yields in the primary auction, in the secondary market during the post-auction session, buying appetite was witnessed as 01.07.25 maturity was quoted at 31.00% and 31.50% while 15.01.28 traded in the range of 32.00%-31.50% while 01.07.32 traded within the range of 30.00%-29.75%.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..