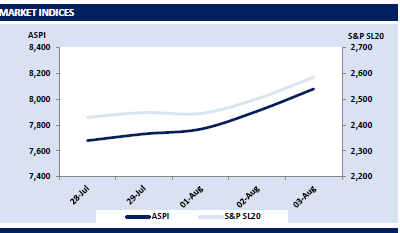

ASPI closed above the 8,000 psychological level for the first time in 2 months as buoyant sentiment persisted in the market for the 5th straight session. Investor confidence swelled with expectations on situations normalizing as the government has temporarily facilitated the availability of basic necessities.

Index opened on an upbeat note and continued to soar high throughout with significant interest in dollar earning companies and closed for the day at 8,080 gaining 173 points. Gradual rise in volumes coupled with heavy retail participation resulted in a hefty turnover of LKR 2.7Bn (+138% cf. monthly average turnover of LKR 1.1Bn).

Capital goods sector led the overall turnover by 25% followed by a 22% contribution from the Transportation sector. However, foreign investors dominated with net selling for the second straight session amidst low participation.

T-Bill auction yields budged lower for the 3rd straight week

T-bill auction yields edged down across the maturities for the 3rd consecutive week with the gradual build-up of confidence of the market participants that was further solidified by the positive news on the current status of the debt restructuring process and the anticipated success on IMF proceedings thereupon.

During the pre-auction session, some buying appetite was noticed on the 01.06.25 maturity with the yields ranging within 27.90% - 27.68%. Meanwhile, at the T-Bill auction, the total offered amount of LKR 87.5Bn was accepted in full and the weighted average yields of 03M, 06M and 1Yr T-Bills lowered to 27.72% (-114bps), 28.97% (-27bps) and 29.19% (-34bps), respectively. Subsequent to the auction, 03M T-Bill attracted some buying in the secondary market and was traded at 27.00%.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..